California Borrowers of Color Are More Vulnerable Than Ever: 2024 HMDA Data Underscores Need for Statewide Policy Change

Google searches for “help with mortgage” have officially surpassed the 2008 housing crisis – as have unemployment rates, food prices, and anxiety about the future. Working class families across the country today face unprecedented financial burdens, with homeownership seeming more out of reach than ever before.

Homeownership is a key pathway to building wealth and stability, yet it remains inaccessible for most families of color in California. To understand this disparity, The Greenlining Institute has analyzed California’s annual home lending data reported under the federal Home Mortgage Disclosure Act since 2015. Collected and made accessible by the CFPB, HMDA data offers one of the only consistent tools for examining demographic trends and lending disparities among borrowers of color seeking to build generational wealth through homeownership.

Throughout this presidential administration, we have seen a rapid rollback of federal policies meant to protect working class borrowers of color from financial inequality and discrimination: the 2023 Community Reinvestment Act update faces rescission; the HUD Office of Fair Housing has reduced staff by 65%; the DOJ has dropped numerous redlining cases; and the CFPB is being dismantled against the interest of national consumers, especially the most vulnerable to financial exploitation.

As financial protections are stripped away, tracking impacts on consumers is more critical than ever. To understand the realities of racial disparities in homeownership access and develop research- and community-based solutions, HMDA data collection must remain transparent and accessible.

Greenlining’s latest analysis of home lending data in 2024 shows that racial disparities in home lending continue to lock California’s communities of color out of the housing market, perpetuating generational wealth gaps and exacerbating the housing crisis. From higher interest rates to excessive closing costs, these communities continue to access homeownership at lower rates than white borrowers and end up paying more to become homeowners.

Unpacking California Home Lending Data

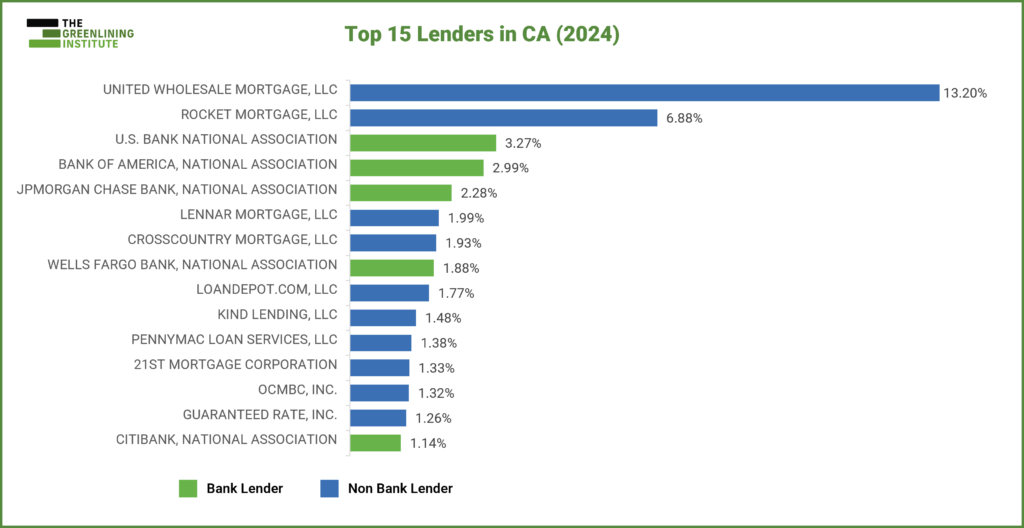

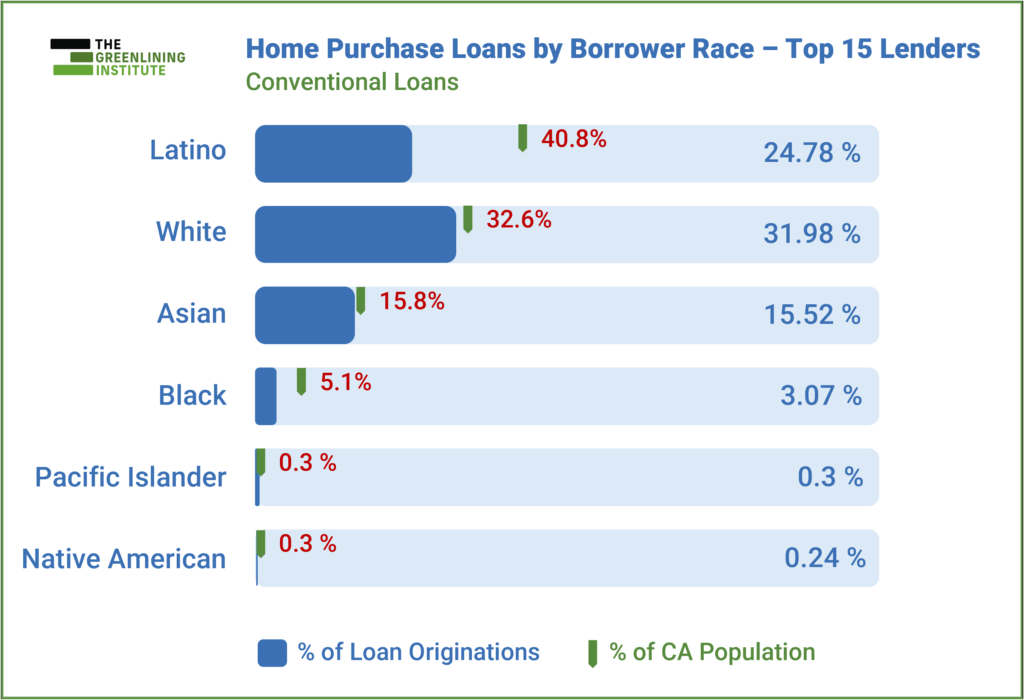

Each year, we’ve found that communities of color do not access home loans at the same rate as their white counterparts, with very little or no improvement year over year. To understand the current state of home lending for communities of color in California, we analyzed the most recent available home lending data covering 2024. We looked specifically at loans issued by the top 15 lending institutions, which represent almost 50% of the overall mortgage market in the state.

Key California Findings:

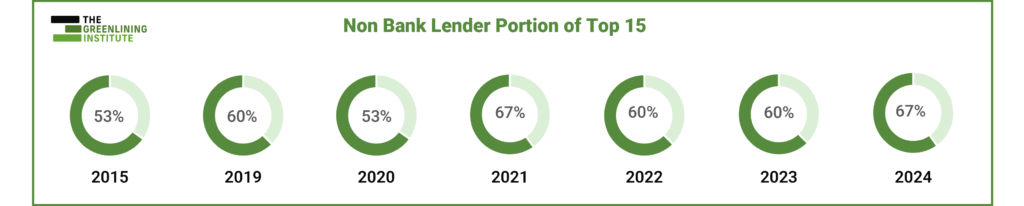

- Nonbank mortgage companies continue to dominate the mortgage market, representing 10/15 top mortgage lenders

- Black and Latino borrowers do not access homeownership at the same rates as white borrowers

- Borrowers of color are more likely to originate a non-conventional mortgage than a conventional mortgage, spending hundreds to thousands more on average

- Banks serve the homeownership needs of Black and Latino borrowers less than they serve white borrowers

Nonbank Mortgage Companies Continue to Dominate the California Housing Market

In 2024, nonbank mortgage companies made up ten of the 15 top mortgage lenders in the state. “Nonbanks” – sometimes known as “fintechs” and “independent mortgage companies” – are lenders that do not offer traditional banking services such as savings or checking accounts, often operating instead as independent mortgage lenders.

These nonbank lenders dominated at least half of the national mortgage market in 2024, with California surpassing the nationwide trend of nonbank dominance by over 13%.

Home lending services are rapidly evolving with the emergence of these largely unregulated lenders and the mass closure of physical bank branches in many communities — particularly formerly redlined communities, low-income communities, and communities of color. While nonbanks and fintechs can help fill gaps resulting from increasing bank withdrawal from the single-family mortgage market, they are not subject to the Community Reinvestment Act requirements and do not have the same legal obligation as traditional banks to meet the credit needs of low-to moderate income borrowers responsibly.

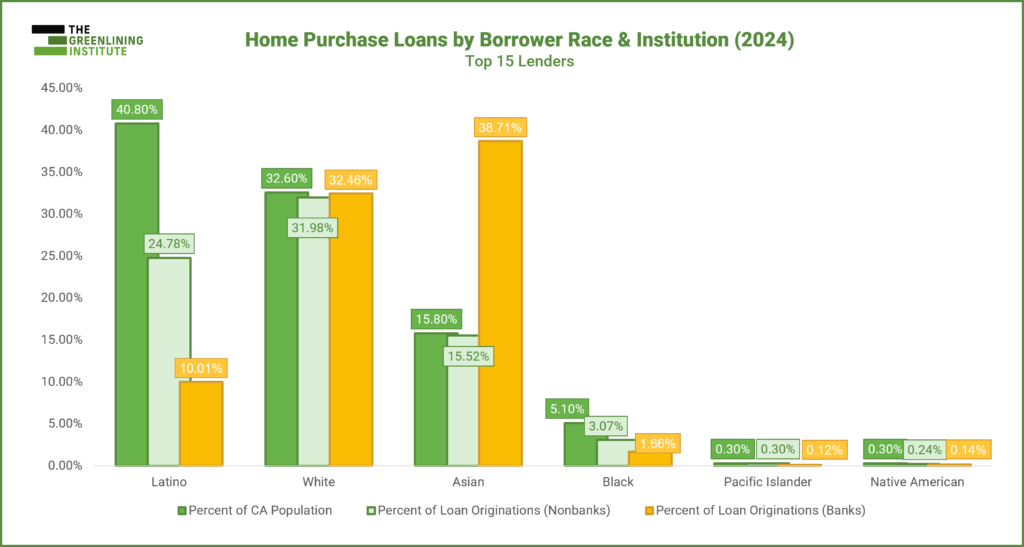

In addition to the growing prominence of nonbanks, we’ve found that even when communities of color have access to traditional banks, these banks are less likely to serve them compared to white borrowers. Shown in the chart below, banks offer significantly fewer mortgages to Black and Latino borrowers than they do white borrowers.

California Borrowers of Color Continue to Fall Behind White Borrowers in Homeownership

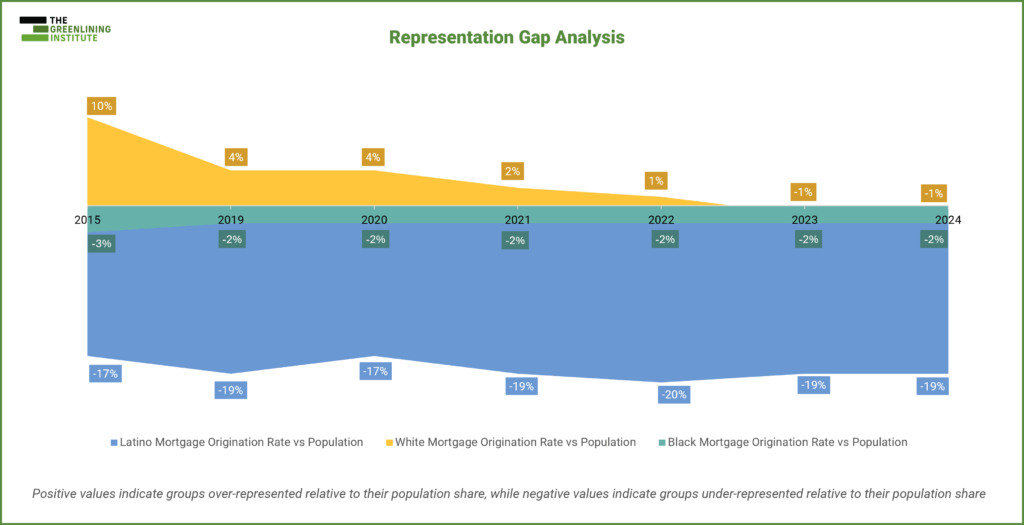

Since 2015, Black and Latino borrowers of color receive mortgage originations at roughly half the rate as white borrowers. Data from 2024 did not break from this trend.

A major source of the disparities we see today is the lingering legacy of redlining — the historic practice by financial institutions of intentionally denying communities of color access to financial services and investments. For generations, this form of systemic racism pushed communities of color to the margins by denying them the ability to live comfortably and build wealth through homeownership.

While redlining was outlawed in 1968, the impact of decades of disinvestment lives on — and at the same time, new forms of financial discrimination have emerged like algorithmic bias, bluelining, and mortgage deserts, further entrenching the racial and economic divides that redlining helped establish.

With the federal government rapidly stripping fair lending regulations from the books, state-level action is essential to prevent California’s racial wealth gap from expanding even further.

Now, let’s look deeper at the types of loans that are being offered to California borrowers.

Borrowers of Color Pay More to Become Homeowners in California

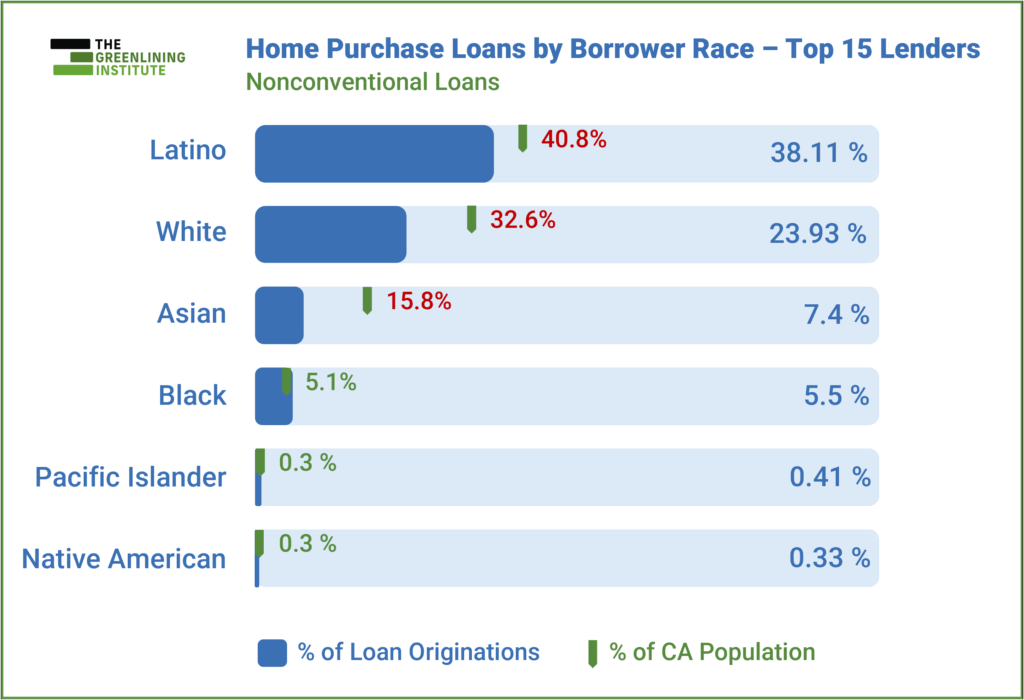

Our 2024 analysis reveals a stark difference in the types of mortgage originations for California borrowers based on race. In 2024, we found that nonbank lenders made 98% of the non-conventional home loans represented by the top 15 state lenders. When diving deeper, we can see that Black and Latino borrowers are disproportionately represented among non-conventional mortgage loan originations compared to conventional loan originations.

Because eligibility requirements are lower for non-conventional, or government subsidized, loans, borrowers of these loans tend to have lower income and lower credit scores. They also tend to be people of color due to a history of economic exclusion and exploitation.

The higher prevalence of non-conventional loan applications among communities of color, or rather the lack of conventional loan applications in communities of color, raises concerns of ongoing mortgage redlining and discriminatory loan steering. It may indicate that lenders are illegally steering applicants of color who could qualify for conventional loans into non-conventional loans, which have more restrictive uses and rigid structures.

What isn’t shown in the data, is that homebuyers pay hundreds more on average if they borrow from nonbank lenders instead of traditional banks. In a recent study, nonbank origination charges were, on average, 24.7% ($487) higher than those of banks. But the disparities don’t end there: regarding closing costs, Black borrowers, on average, paid $256 more in loan fees than White borrowers, while Hispanic borrowers incurred an additional $270.

Borrowers of color, who are more likely to be non-conventional mortgage borrowers, tend to face additional cost burdens, such as:

- Mortgage insurance

- Higher, subprime interest rates

- Excessive junk fees and closing costs

- Lack of emergency funds, creating vulnerabilities to foreclosure

- Increased climate risk in redlined neighborhoods, resulting in rising insurance premiums or no insurance coverage

- Costly or limited access to refinancing

The economic repercussions of historic and ongoing systematic discrimination mean that communities of color face higher barriers to accessing conventional home mortgage loans, and as a result, pay more to become homeowners through non-conventional mortgages primarily offered by nonbank mortgage companies.

Because nonbank lenders are not obligated to fair lending practices and reinvestment activity, this trend overexposes communities of color to potentially predatory and unsustainable lending patterns which if unchecked, threaten to replicate the impacts of redlining with the rapid deregulation of fair lending laws occurring nationally.

California Must Take Bold Action to Protect Borrowers of Color: The Time for a California CRA is Now

Rapidly rising costs of living in California paired with federal deregulatory efforts are paralyzing wealth-building opportunities for communities of color. Anxieties are high, and working class families are bearing the brunt of corporate greed. If mortgage companies continue to profit off our communities with excessive rates and fees – with five of the top nonbank California lenders raking in over $19 billion in revenue in just three years – they must also be required to reinvest those profits back into the communities they serve.

2024 HMDA data highlights that lending conditions for borrowers of color continue to be impacted by the legacy of redlining. Families of color are not accessing conventional home purchase loans at rates comparable to white communities, and are more likely to access loans through largely unregulated nonbanks which charge them higher rates and fees, making homeownership more costly and difficult to achieve in the long run.

While mortgage lenders throughout the state profit off our communities with no transparency or accountability, California communities of color struggle to put food on the table or a roof over their families’ heads. AB 801 – The California Community Reinvestment Act – would bring an estimated $15 billion yearly to working class communities through housing development, affordable products and programs, and capital access. The bill would also ensure fair-lending is upheld by all state-chartered lenders as the regulatory agencies erode the last remaining federal protections for borrowers.

Housing stability must be a human right, especially for formerly-redlined communities in the most expensive state in the nation. California must take bold steps to support communities of color by filling in the federal regulatory gaps as we always do – and now, California is trailing behind. We now have the opportunity to defend homeownership for our most vulnerable communities in the state with the California Community Reinvestment Act.